Zhishi TV - From Research to Design

A creative attempt in short video market in 2017, when TikTok was not yet popular

You can right-click “Open Image in New Tab” for larger images (可以右键“新窗口打开 ”放大图片)

Table of Contents

- Zhishi TV - From Research to Design

- Table of Contents

- Product Concept in short

- Market Research - Smart TV Market Overview (2018)

- User group analysis

- Competitor Analysis

- Operation Analysis

- SWOT analysis

- User research

- Persona

- Interaction Design

- High Fidelity Mockups (highlights)

- Learnings

Product Concept in short

For educated and curious young people to easily consume learning-oriented content,

Our Zhishi TV is a high-quality original learning-oriented short video platform,

It allows you to easily browse interesting and informative short videos created by various KoL/professionals/power users,

Unlike other knowledge content platforms based on images and texts such as Zhihu, Guokr,

Our product has vivid sound and picture effects, large screen viewing, and an immersive experience.

Market Research - Smart TV Market Overview (2018)

Expand/Hide

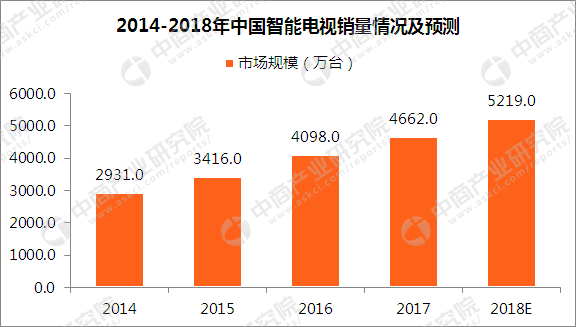

Market trend

-

Apple TV is not available in China, and unlikely to become available anytime soon.

-

The smart TV market has a relatively large user base and is still growing rapidly at this stage (total number of smart TV users: 148 million units were activated at the end of 2017, 2018 Q1 ownership growth rate was 6%, and activation volume growth rate was 11%.

- There is no popular first-party (content producer) App in China, such as Netflix, BBC (BBC iPlayer), HBO GO, etc. Moreover, in foreign markets, most TV apps with high downloads and huge revenue are supported by strong content. For example, the main content of YouTube is UGC, while Netflix, BBC, and HBO are PGC+IP (original series/movies).

User Usage

- The average user usage time is 4-5 hours a day, light users mainly use it at night, and heavy users will use it all day during the day. Holidays will be more active.

User Portrait

- The majority part of the users was born in the 80s and 90s. The family structure is dominated by singles and small nuclear families with up to three members. There are more users in east China.

Overview of video-on-demand app on TV

- Video-on-demand is one of the most important user demands. Among them, entertainment content such as films, series, and celebrity shows are most popular. They account for more than half of total TV app downloads. Among top 100 on-demand apps in Dangbei Market are content-mixed platforms. The top 10 tend to be TV versions of their mobile apps (Tencent, iQiyi, Youku, etc.).

Short video app overview

- The user base of short video TV apps is still relatively small (on mobile this number is increasing rapidly). This type of app mainly focuses on vertical content, most being news and sports content. There are also some popular TV apps focusing on games and anime. Fitness-based video apps have also gained popularity, such as sports, yoga, and dancing. Learning-oriented video apps are mainly about pre-school education.

TV App Market Overview

-

It’s totally chaotic. The mainstream app download markets include Xiaomi TV App Store, Aliyun App Market, Chipper Market, Dangbei Market, Sofa Manager, etc. The markets of Xiaomi and Ali are more mature but are limited to certain manufacturers. You can find hundreds of bad-quality apps, and even malware apps in these markets.

-

The design of most apps is still in the exploratory stage, and there is no consistent experience. Different apps tend to have different interaction modes/remote layouts, resulting in a steep learning curve for new users.

Summary

-

The Smart TV market has a huge user base, rapid growth, long user consumption time, and concentrated user behaviour. This market has important strategic significance for the long-term development of video distribution/production.

-

At present, the backbone of large-screen Internet users is the 26-35 year-olds in economically developed provinces, which basically coincides with the target users of our knowledge-based short video app.

-

The consumption of video content on the big screen is still dominated by entertainment content such as film, series, and celebrity shows, while short video apps are relatively less consumed.

-

The market segment of short knowledge videos is still a blue ocean, but it also means that the market needs to be cultivated with high-quality content, fresh and easy-to-use interactive experience, and time.

-

Most of the existing video content on the big screen is produced by the professionals (film, series, celebrity show production companies). This means that large-screen TV users have high expectations for the quality of content on this platform.

-

Therefore, to focus on learning-oriented short videos, we must provide high-quality content, instead of going for “quantity no quality”.

User group analysis

Expand/Hide

We started interviews with families and friends. As part of user research. we created assumptions based on our life experience, and talk to colleagues, families and friends.

Assumption 1: New grads to workplace

Expectations on TV APP

- Better user experience and interaction on TV

- More comprehensive, richer and higher quality video content

- Hope that the production is professional, more “real stuff”, less mass-produced content

- More accurate recommendations, quickly find what you want to watch

- Innovative mini-game, but nothing too heavy like video games

- good for family sharing

User Purpose

- learn something, and fulfil curiosity

- Realise what I want to watch with accurate recommendations

- To kill time, it is best to have an continuous experience, so don’t be too short (>10min)

User Pain Points

- It is generally reported that TV interactive is inconvenient, video control is difficult, searching is difficult

- Too many ads

- I won’t even remember to turn on my TV

- Interaction is inconsistent from TV to mobile app

Usage scenarios

- Evening after work, and leisure time on weekends

- Connect to a computer to watch movies, TV series, etc. (especially foreign movies and TV series that are not available on domestic video platforms) (pirate)

- Connect to game consoles

Design opportunities

-

Like MasterClass, learning and studying videos are can be combined with celebrities, such as Zhou Yiwei, Zhang Yi and other famous actors talking about acting. Luo Ji Thinking and Round Table School focus on thinking methodologies, and Readers focuses on reading and fictions. They are targets we aim, and can be distributed to specific user division in our TV app.

-

From another perspective, users’ needs may arise on a certain occasion. For example, before travelling, users tend to have high demands for destinations and guides. For fitness, please refer to celebrities’ fitness training videos, etc.

-

The interaction should be consistent with mobile apps, or even use the smartphone as a remote

Summary

- This part of the population is a strong part of potential user groups, and key profit contributor. They have high expectations for TV APP and high willingness to use it

Hypothesis 2: Married and owns an apartment

User Traits This kind of people will watch TV more frequently with family.

Typical scenes include watching dramas with their loved ones; watching movies; watching cartoons with children, watching news with the elderly, etc.

The role acts as a link between family members, the content format is more suitable for multiple people to watch, meaning mainly entertainment content such as movies and TV shows

User Purpose

- They hope that TV can have more content suitable for family viewing, and they are willing to pay for family viewing needs

- Interested in knowledge-based short videos, but hope that the content has enough highlights and differences. Also need opinion leaders who they can follow.

- The duration is considered to be at least 20 minutes, otherwise they feel a lack of depth

Usage scenarios

- Mainly night and weekend. One single watch time is longer and but also depends on the content

- The frequency of watching TV alone is low, and the content is mostly relaxed and entertaining

User Pain Points

- Not much TV content suitable for family viewing

- Too much attention taken by smartphones, it would be horrible if everyone in the family does that

- Interesting resources are hard to find, and certain content are somewhat restricted

- The control of the TV is not very smart

- High-quality knowledge videos are rare to find on TV

Possible Solution

- Use machine learning to push content users are interested in

- Use formats that are more in line with the rhythm of modern people (Shorter, leaves space for audience to think)

- Make TV apps lightweight, focused on a specific area of topics. Not flooded by too much options

- Use smartphone to control TV apps and extend mobile app beyond a remote

Design opportunities

- Highlight the interactivity of the family, such as videos for children to teach and play, suitable for TV watching

- Align smartphone and TV apps

Summary

- Overall, this is our main user group

-

This part of the population is basically the same as our user positioning. The main variable appears as family, but we mainly focus on the first- and second-tier city young families, whose members tend to fit within our content taste.

- The key is how to make a difference in content, and whether we have delightful surprises in user experience

Hypothesis 3: Those who live with their parents

User Traits

- For such users, watching TV is an important way for them to accompany their parents, so the content selection and usage habits of TV will be based on the wishes of their parents. When they need to watch the content they are interested in, they usually choose to watch it on a mobile phone, ipad or computer

Usage scenarios

- Dinner time on weekdays, about half an hour each time. The content to watch is usually news, sports events, CCTV documentaries, variety shows, etc. Commonly used TV on-demand functions

- 2-3 hours at a time on weekends to watch movies and variety shows. If the TV system itself does not provide a rich variety of movies and TV shows, they will use their mobile phones to search for relevant content, and then cast to the TV screen to watch

- Most of the time they will watch with parents, and the content to watch is mainly based on the choice of the parents

Demand for fun learning-oriented video content

- Most users themselves have the habit of watching interesting knowledge videos. They tend to like well-made content with fun life hacks

- They are willing to pay long-term attention to the learning-oriented video producers they follow. If the content meets their interests, they are also willing to pay.

- For celebrity-related knowledge content, they are more curious about the sharing of professional fields such as actors and singers, but are not interested in traditional programs on gossips

- The vast majority of users now watch this type of content on mobile

Needs for knowledge-based interactive games (e.g.Brain Kings)

- The users interviewed are all interested in this type of game. They have spent a week or two playing the Brain Kings on WeChat. They are more interested in the way of competitive ranking and are willing to continue to invest time in order to improve their ranking.

User Pain Points

- The standard TV set-top box has few interesting resources, and it is difficult to download apps

- Nowadays smart TVs and boxes have too many remotes

- TV OS is slow

Possible Solution

- Pay attention to the simplicity and ease of use, consider using mobile phones to reduce the difficulty of interaction

Summary

- **The content and methods of smart TV consumption of such users are based on the wishes of their parents. However, they themselves have a demand for knowledge-based interesting videos. If the content is appropriate, they may be able to guide their parents to watch them together. It is recommended as a secondary target user group. **

- This group has higher requirements for the quality of APP

Competitor Analysis

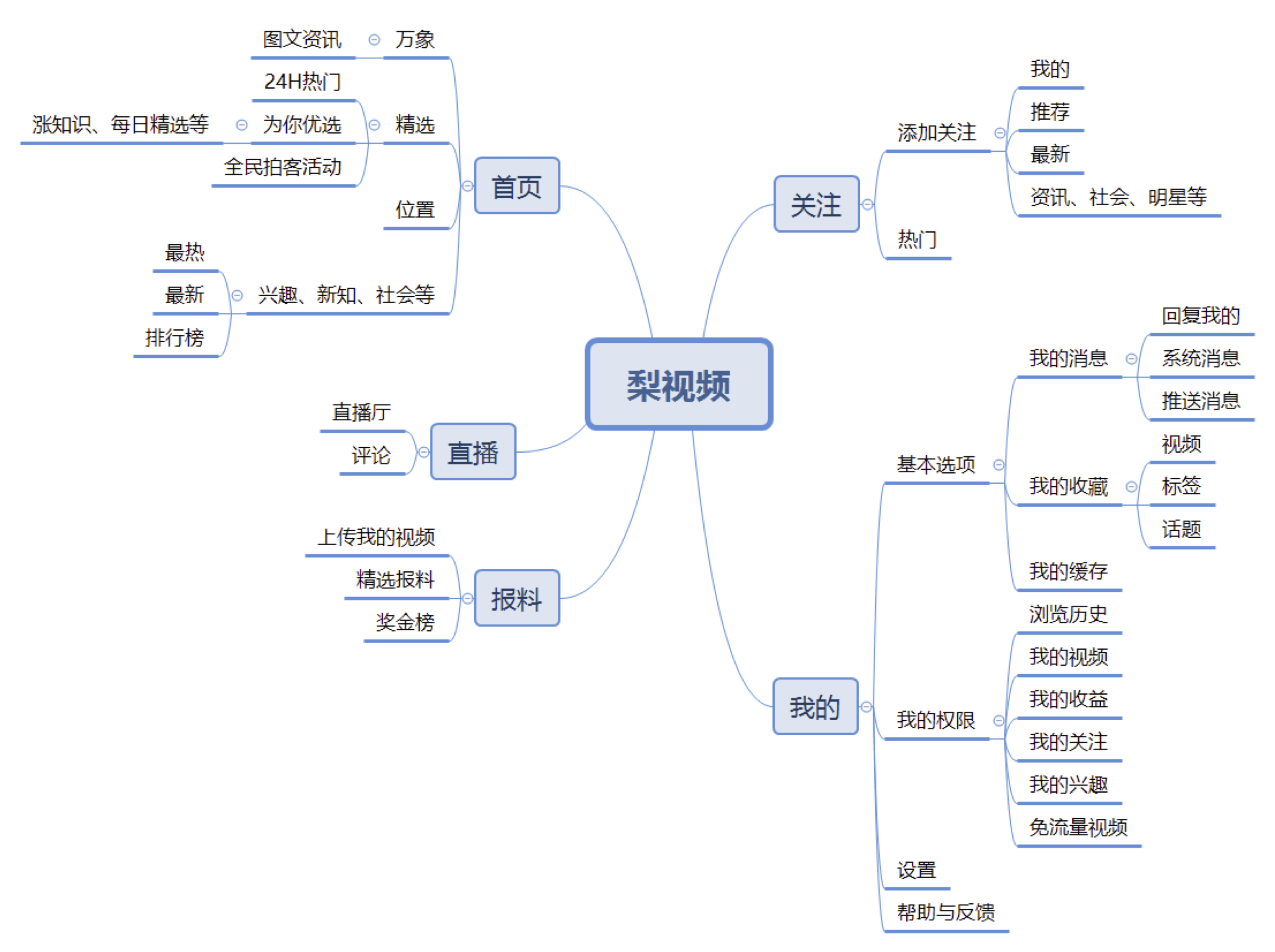

liShiPing

Expand/Hide

Type of competition: Indirect

Product Positioning

- A consulting short video app platform that has a wealth of self-made short video content resources and meets the tastes of young people

- slogan: Make the best short information video

- Target users: young people who need high-quality short videos and photographers who are keen to record stories around them

Product Features

- You can choose different tags to customize the video content according to your interests

- High-quality and rich content, clear classification, including multiple types, ranging from 30 seconds to three minutes

- Able to watch live broadcast

- They encouraging everyone to become a photographer and publish the story they saw

Structure

Interaction/Visual

- Mainly white, with yellow accents, the design style is simple and lively, not overwhelming, and it sets off the rich colors of the short video cover image.

- The exclusive video playback interface is equipped with the theme color of LiShiPing-yellow and white text to assist in explaining the basic situation of the video, as well as some expressions that interact with the video content, which fully reflects the intention of production, so users have formed a sense of series, which has a higher degree of recognition.

- The video is presented in a waterfall stream, and the recommended video pictures on the homepage use a large proportion for dynamic effects, which can effectively attract users’ attention and increase clicks

- Most of the videos are in horizontal version, click the play button and it plays with no delay. A small number of vertical videos will automatically fill the screen, the experience is very smooth

Content

- High-quality and rich content, clear classification, a large number of original videos, including a variety of social, technological, entertainment and other types, ranging from 30 seconds to three minutes, and a large amount of live content that’s longer than 100 minutes

Conclusion

- We cannot provide content as rich as LiShiPing, but more focused on the knowledge-based and interesting content shared by celebrities

- LiShiPing’s news reporting function is a good reference point for our products, because the product is also oriented to PGC producers. With this function, we can rely on the TV platform to obtain greater exposure, increase the visibility of the author and the app platform to achieve a win-win situation.

- LiShiPing’s design and details of its video playback interface is very worth learning. With the help of the TV platform, the emotion and experience are boosted due to large screen size

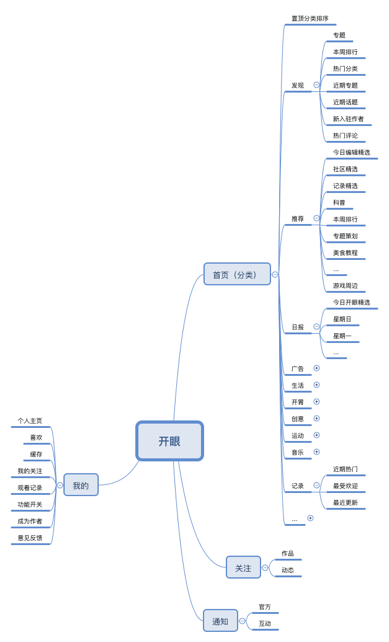

KaiYan

Expand/Hide

Type of competition: Indirect

Product Positioning

- Recommended platform for high-quality HD short videos

- Slogen: Open your eyes with daily video recommendations,

Target users

- Young users who need high-quality short videos, and PGC creators with professional background knowledge who need to show their works and find creative inspiration.

Advantage

- Content: The overall quality is high, and technology and operation methods are used to achieve effective screening.

- Product: The structure is clear, the vision is refreshing, and it gives a strong sense of quality.

- User: word-of-mouth communication, high user loyalty.

Disadvantages

- The playback format, content, and video length, to a certain extent, cause users to be less sticky

- The strength of entertainment short videos such as Douyin has diverted users to a certain extent.

Product Features

- Recommend five short videos daily

- Find short videos by category

- Search by video, author, user and tag

- Follow quality authors and get their latest videos in time

- Comment section to share thoughts and feelings

- Become an author and publish your own creative video

- Cache video, watch offline

Structure

Interaction/Visual

- Interactive

- The information level is flat, and the browsing content is strong.

- The content is highly subdivided, and the tags are multi-dimensional to fit users’ viewing preferences

- Smooth transition effects, for example: when viewing on a small screen, just pull down to close the current page, which is very convenient for one-handed operation.

- Light function, heavy content. The functions are pure and simple, and the content is rich and high-quality, which meets the needs of current users to obtain higher-quality content in less time.

- Visual

- The main color is black, white and gray, and the icon is a minimalist geometric shape.

- The concise processing can just highlight the sense of quality, and the achromatic color brings out the colorful video content.

- Large fonts, blank spaces, clear content levels.

- The carefully curated high-quality video itself constitutes the main visual subject in the main scene, with a strong sense of immersion.

Conclusion

- The early content of our products will not be so rich, but one thing is clear, that is, differences and high-quality are the key points.

- Kaiyan’s target users are audiences who need to watch high-quality videos, also many high-quality PGC producers. On this platform, these professional producers and creators can also display, communicate, and create inspiration. Their content and creation creates a positive and sustainable closed loop, definitely worth learning from.

- In addition to content, Kaiyan is relatively restrained in terms of functions and operations. Maybe their user traffic will not explode like Douyin, but relying on content sharing and dissemination, the number of users is stable and expected to grow.

- The comment interaction function may not be directly transferred to the TV, but the combination of mobile phone and TV may be able to collide with more interesting ways of interaction.

- Light function, heavy content, also suitable for our TV terminal.

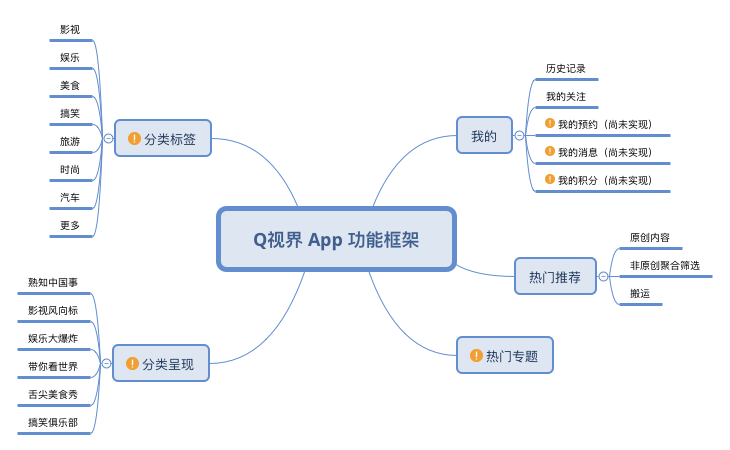

QHorizon

Expand/Hide

Type of competition: Indirect

Product Positioning

- It is officially positioned as a short video interactive community sharing application on the TV side, but in fact the interaction at this stage is very limited, only likes and attention

- We position its product as [PGC + integration] short video platform

Product Features

- Recommend popular original content

- Play videos according to categories

- Play videos according to topics

- Recommend videos based on views

- Like the video

- Follow a topic

- Play history

Structure

Interaction/Visual

- Use black as the background color, so that the interface will be suitable in a dark environment, taking into account the night use environment of TV

- The interaction is simple and easy to understand, the UI is clean, and with play history, but lacks time information

- Like, follow, and make appointments without registration (not completed)

- No search function, category does not cover all programs,

- The style of each block is not uniform and appears messy, and there are too many details, such as alignment, color and font

- The functional structure is not clearly defined, for example, “Hot Topics” does not correspond to an obvious topic entry, and the classification label does not correspond to the information flow classification name of the main interface, causing confusion

Content

- There is little original content, mainly videos collected from the Internet

- Part of the content is the trailer or promotional film of the original program, although it is short, it does not provide the audience with the entrance to watch the full version

Conclusion

- We can learn from its recommendation system. The history function needs to be placed in an obvious place and needs time information. Classification needs to be concise and clear

Operation Analysis

Expand/Hide

“Content is King”

- Video TV apps must include sufficient content, from movies, celebrity shows, TV series, documentaries and other forms of content

- TV apps need to stay advantageous in film and television procurement, such as iQiyi’s, Netflix’s, Hulu’s original series.

- Have original PGC, clear classification, and of course content quality

Distribution Channel

- Cooperate with TV manufacturers to acquire original users and expand app installations

Refined operation-user tag management

- In an era driven by refined operations, the basis of refined operations is to understand users and what they want, thereby improving operational efficiency

- User tags are the tagging of user information. In simple terms, they use some strong general vocabulary to describe or describe user characteristics, interests and hobbies

- After the user tag management system is set up, it means that the user portrait has been formed. The operation cooperates with the user information tag to group users with similar tags into a group, and conduct more flexible and targeted marketing activities for them

Recommendation Mechanism

- Through big data and recommendation engine, recommend different content to users who may be interested in them

- You can refer to YouTube’s automatic playlist system to make users interested in watching continuously

- Recommend programs through program ranking, guess what you like, friends watching, and interactive games

- The user can subscribe to a certain author or column. After he subscribes, any updated information or broadcast information will be notified to the user in real time to increase the viewing time of his startup

Activity

- Increase the enthusiasm of users to pay through preferential activities and member promotions

- Promotion and promotion through festival activities

SWOT analysis

Expand/Hide

S

- The positioning of our product is unique, with few direct competitors

- There is original PGC to attract audience

- Informative topics cater to the needs of specific audience groups

- Knowledge-based topics are more consistent with TV use scenarios (relaxation, willingness to listen, longer free time, no frequent operation and interaction)

- Focus on vertical content, no need to search for interesting topics

- Add interesting interactive experience between programs, highlighting the concept of family interaction

W

- Using the app as the entrance will cause some potential users (interested but not strong) to leave, because they needs to go through 3 steps: searching, installing, and learning to use our TV app

- Slow update of original content

- Compared with the mobile and the web, TV has a disadvantage in the form of short videos, because short videos are more suitable for occupying fragmented time, so watching short videos on mobile terminals is more popular

O

- Different from foreign markets, the China market does not have a dominant broadcasting platform (YouTube, Podcast) for intellectual content. Small but sophisticated brands such as “Logical Thinking”, “Creative Agency”, “Zhihu Live” tend to avoid expansion to TV. The audience would have high acceptance

- Because the content is focused, there are fewer core functions and fewer restrictions, so you have the opportunity to develop a more beautiful UI and convenient interaction than similar apps

T

- Large platforms such as Tencent Video, iQiyi, and Youku also have knowledge topics and will seize a portion of the market

- PGC producers may choose multiple platforms to publish content at the same time

- The amount of exclusive content depends on the competitiveness of the platform, and the initial update speed may be too slow

User research

The preliminary research includes Competitor Analysis, Behaviour Analysis, SWOT Analysis, Questionnaire, Interview. A total of 26 people were interviewed by 4 designers.

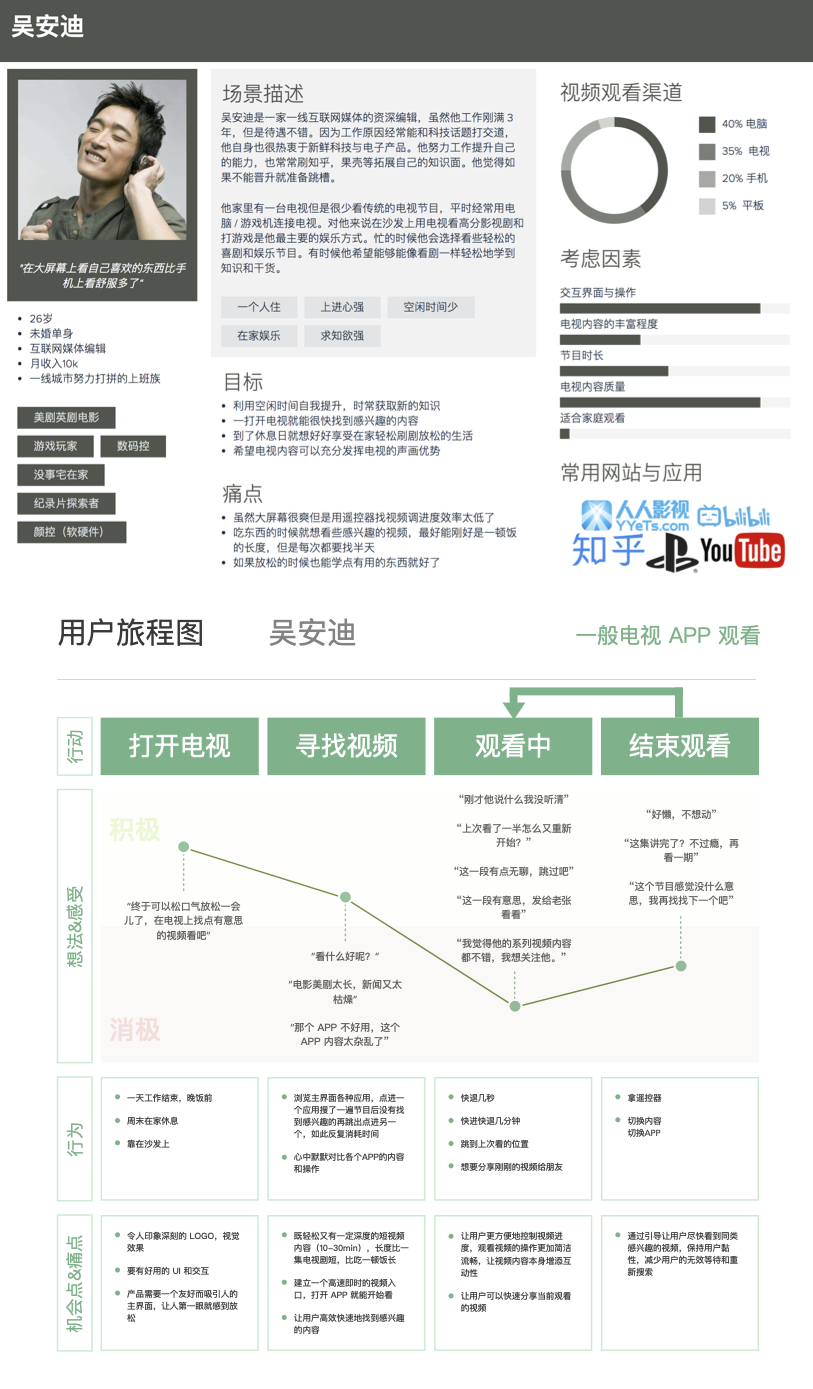

At the end, we identified two main user groups using statistics analysis. And I created 2 personas and 2 journey maps.

Research findings

Common characteristics of target users

- The viewing time is mainly night and weekend

- Mainly focus on relaxing and entertaining content

- A higher proportion of family together watching TV

Target user needs

- More accurate recommendations, quickly find what you want to watch

- Overall, there is a strong demand for interesting and intellectual content

- There is a potential demand for short video on TV

- A better and more immersive interactive experience

- Lighter App

Persona

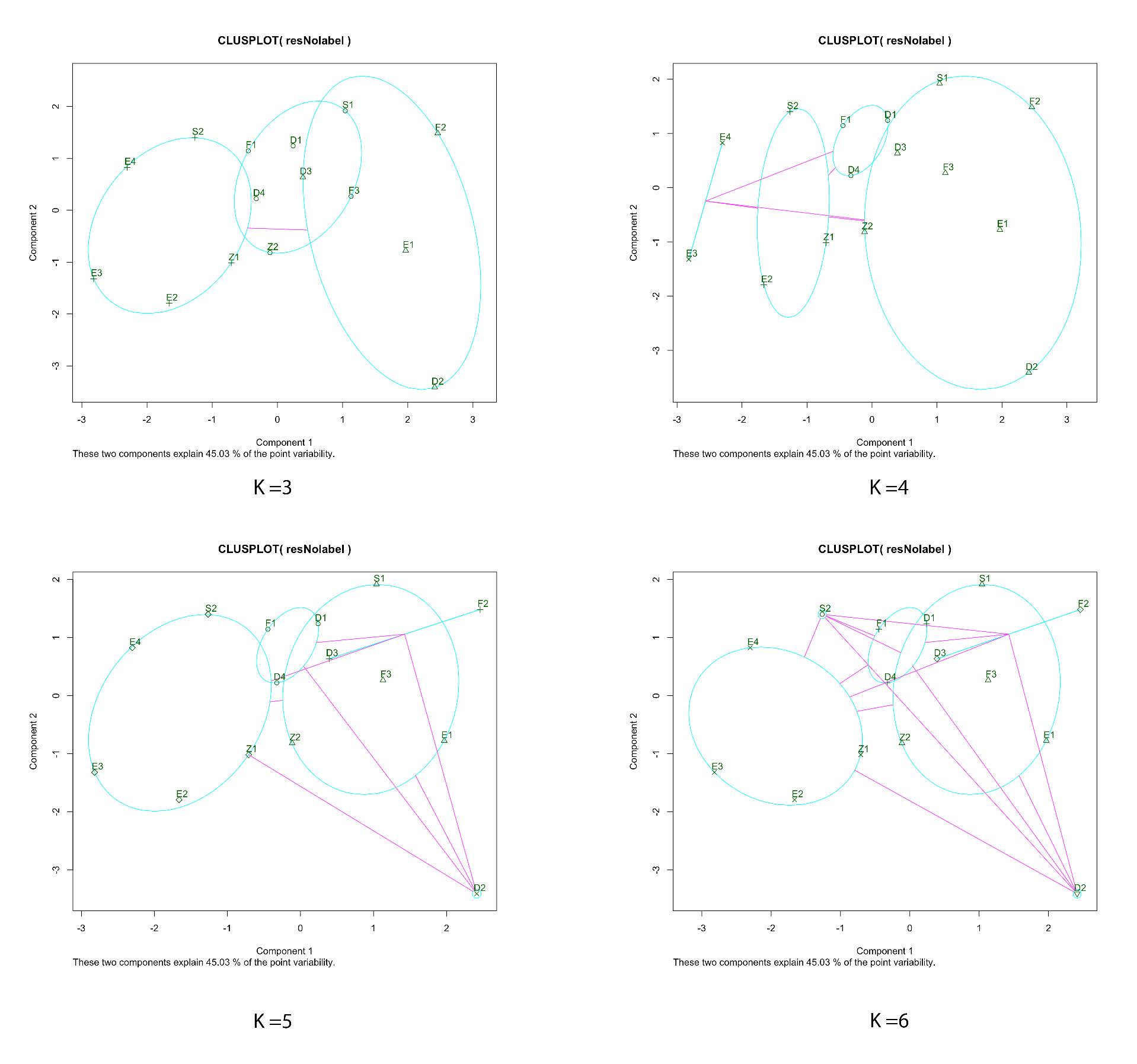

I wish to highlight this part as I used statistical methods to analyse interview findings, which is a efficient way to help the team reach consensus

First, quantify the answers from user interviews before statistical analysis can be performed.

I used the K-means Cluster algorithm to measure the geometric distance between users (R studio). Then, the outliers that are removed, by adjusting K value, the nodes with similar distances are divided into one cluster. 3 clusters represent 3 user groups. According to the analysis hypothesis of the user group in the early stage, it is further integrated into 2 groups and 2 usage scenarios.

The degree of matching between persona and user group assumptions is very high, which supports the previous user research assumptions. Then I continued to create a journey map based on personas.

Single-person usage scenarios emphasise personal experience and accurate content search. This scene is the main use scenario and is also a high frequency scenario for the target user.

Family use scenarios, emphasising family experience and content recommendation. This scenario is a secondary use scenario, and is the main scenario for expanding the user scale in the later stage of the product.

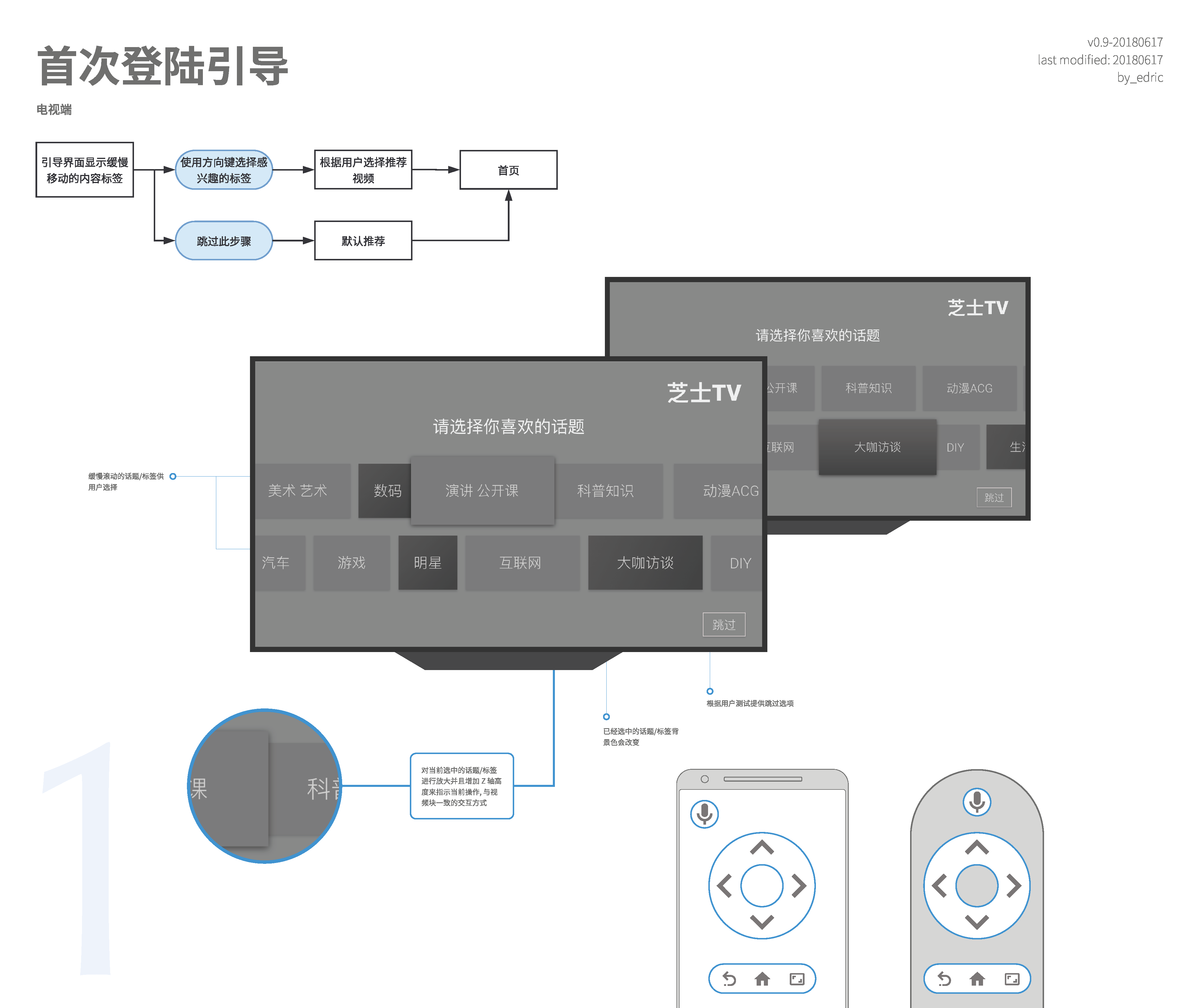

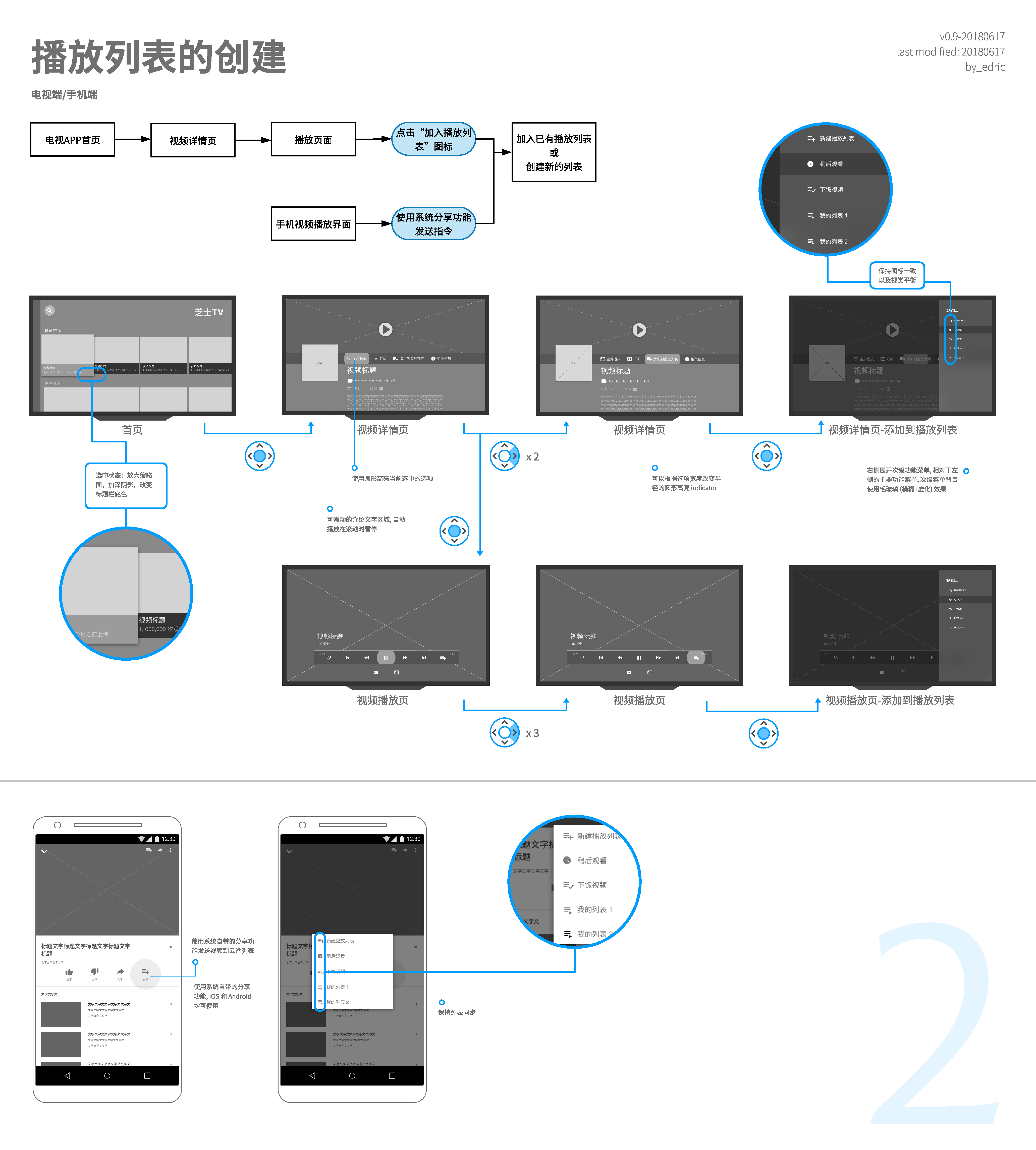

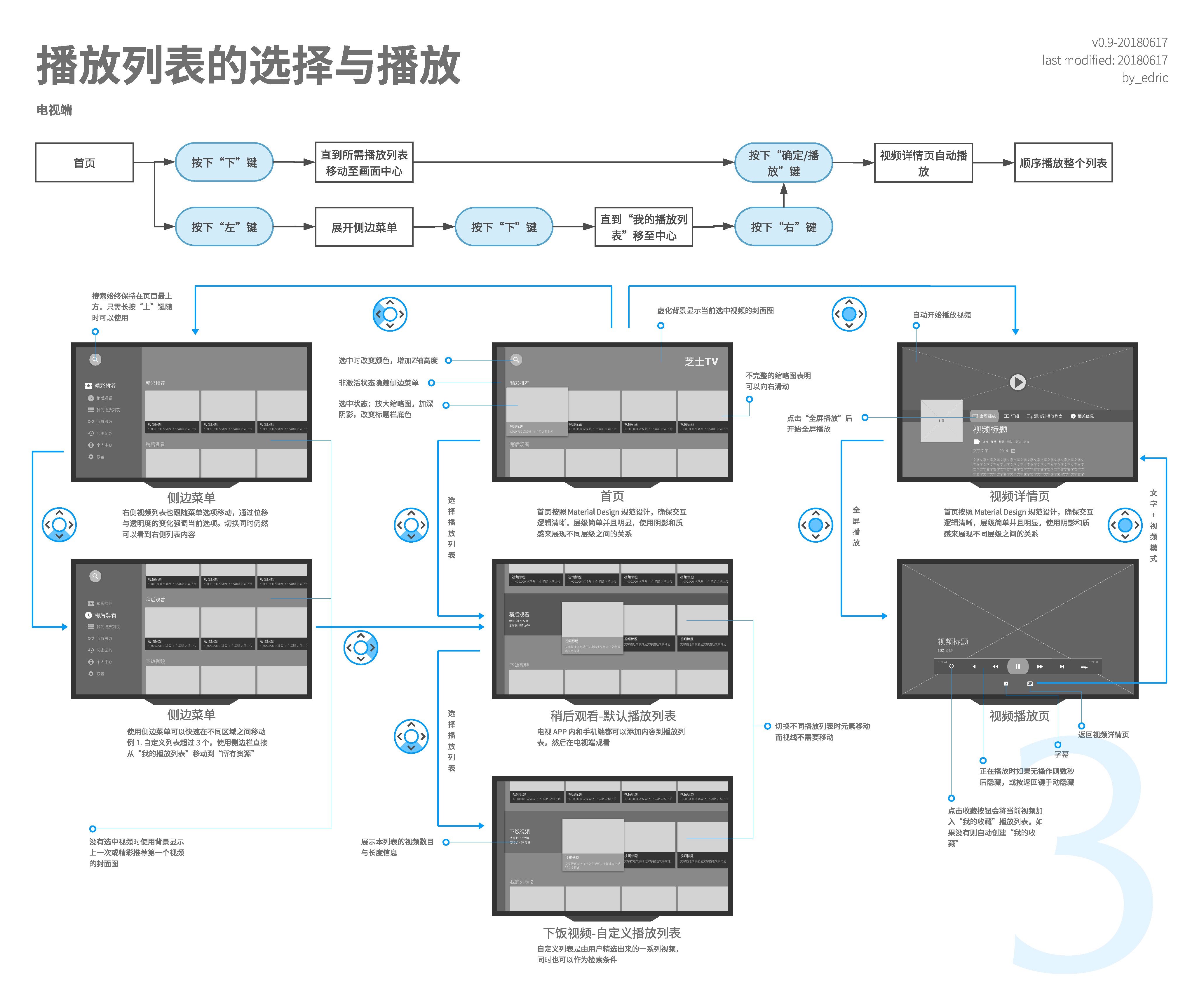

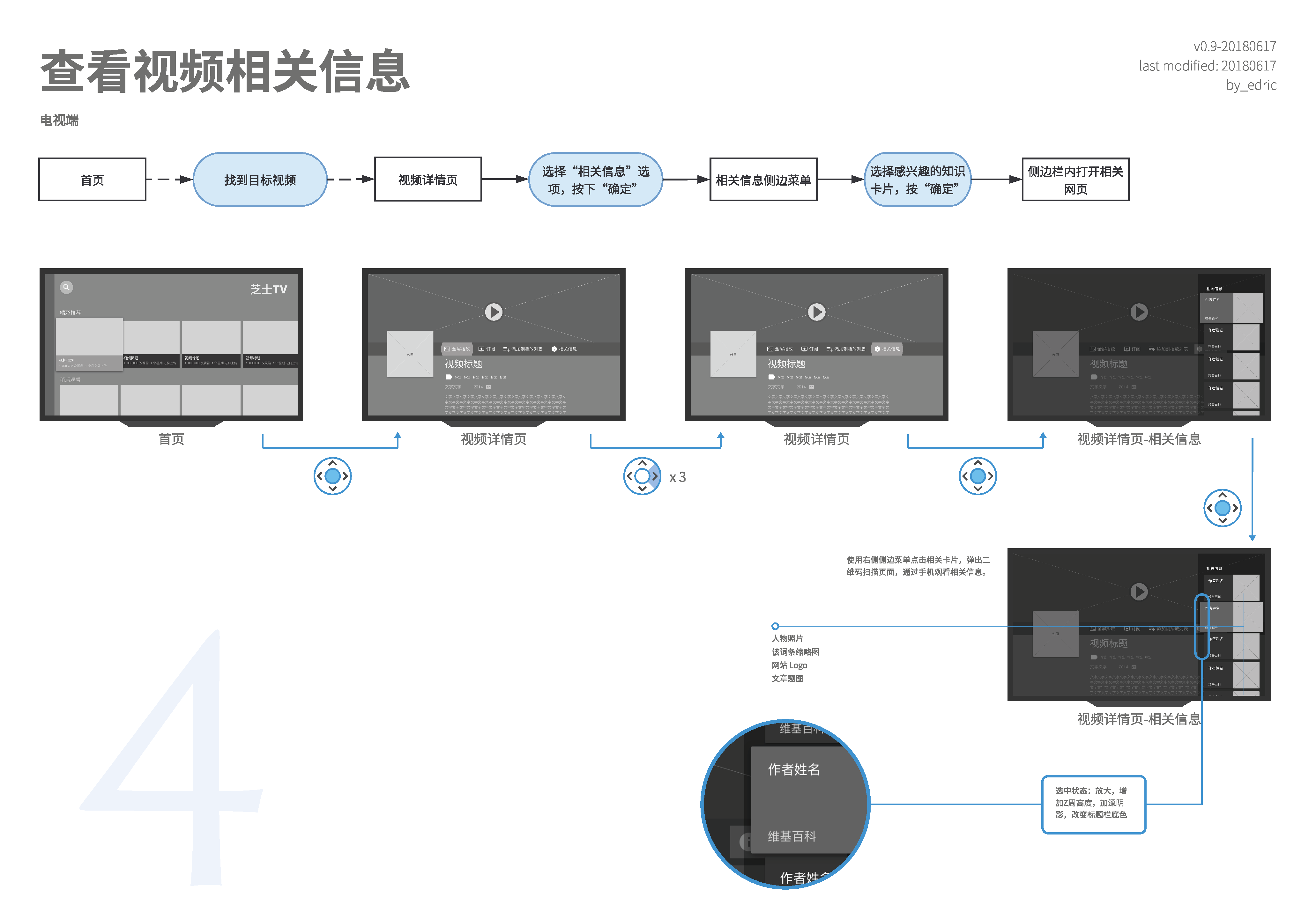

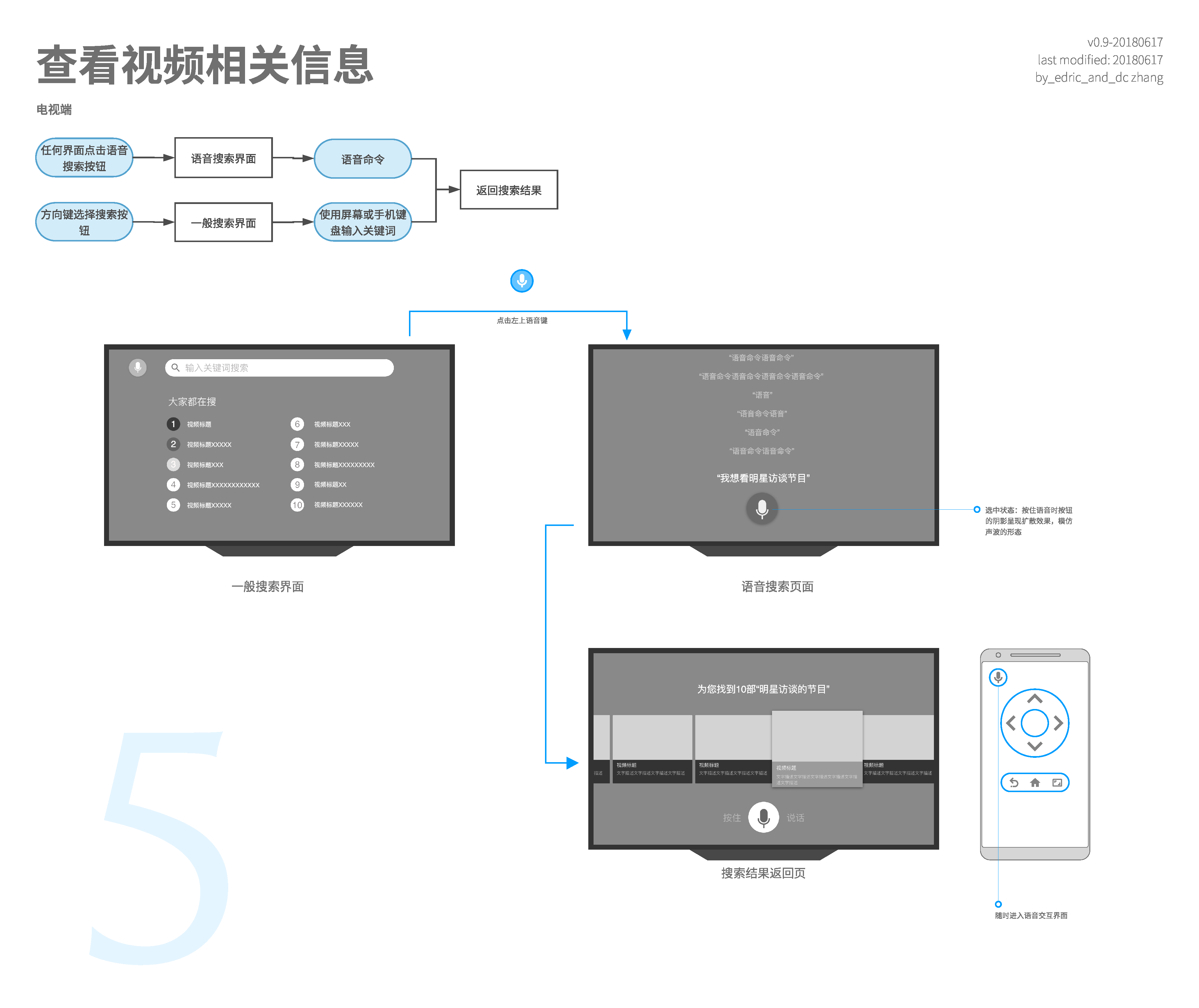

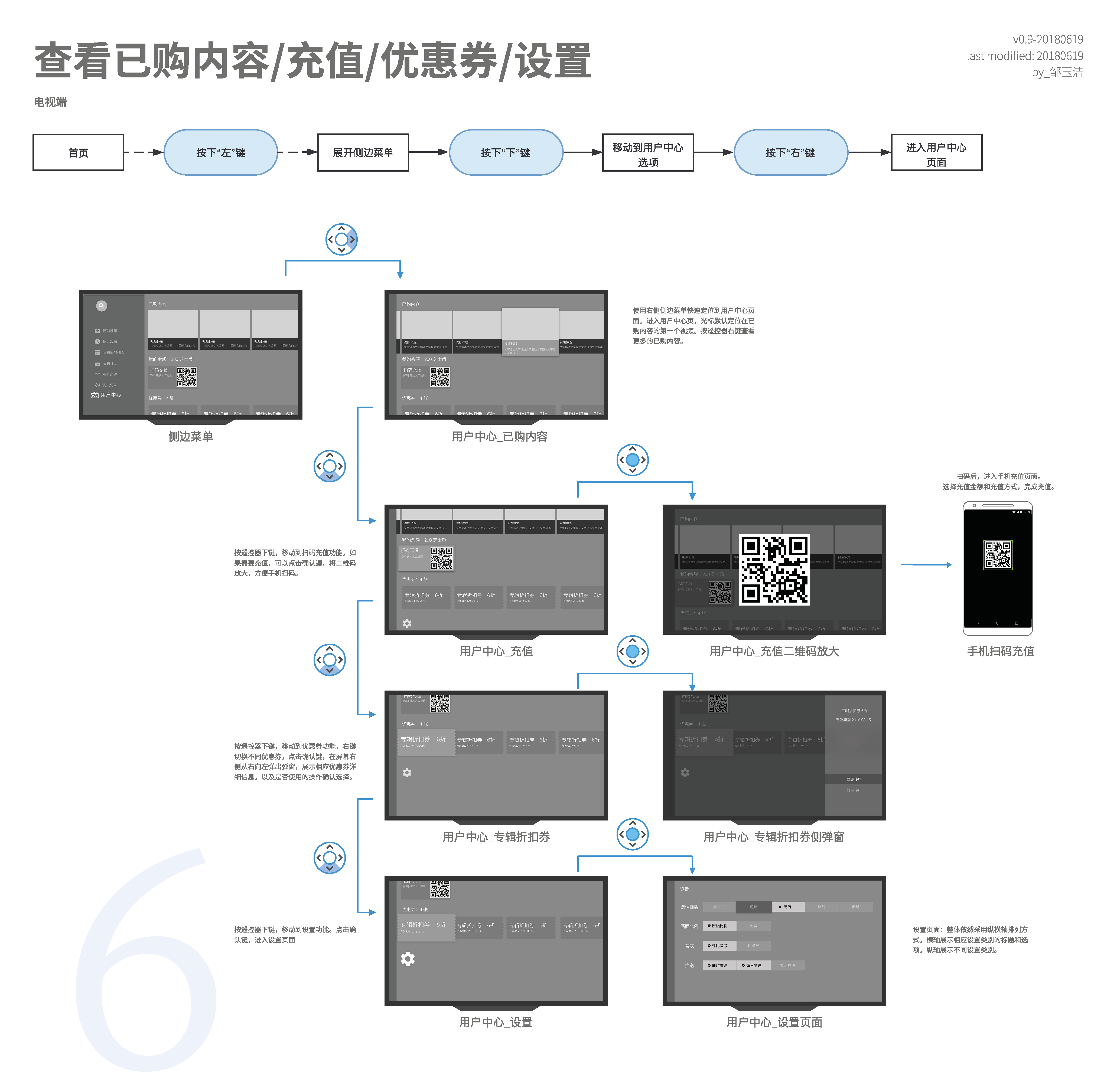

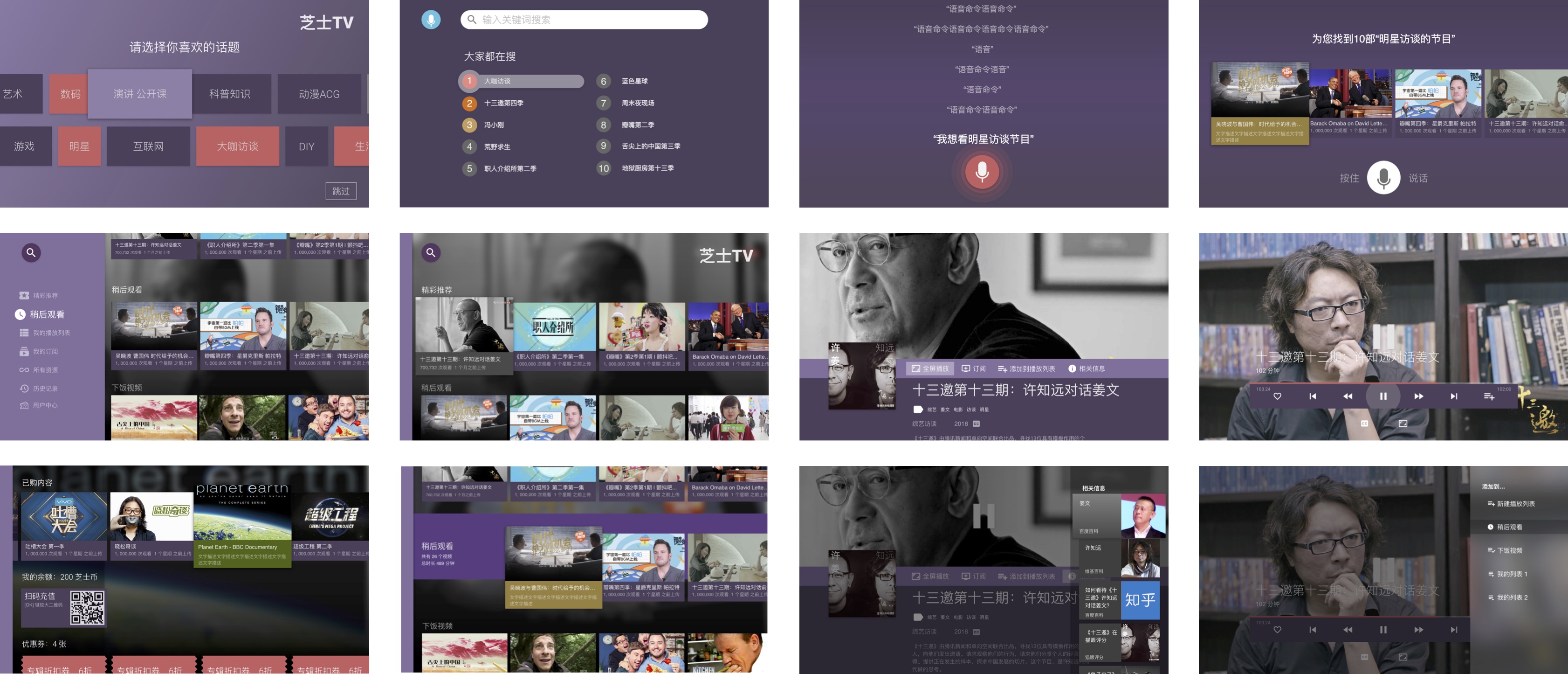

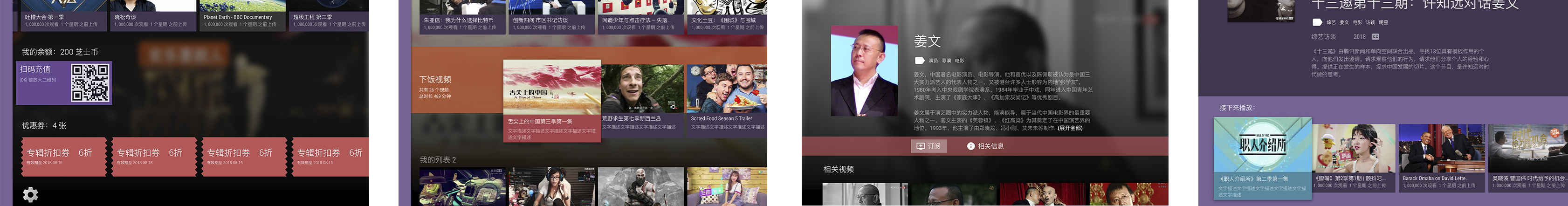

Interaction Design

Interaction description and user flow. The interactive instructions are made according to the remote control/smart phones.

You can right-click “Open Image in New Tab” for larger images (可以右键“新窗口打开 ”放大图片)

I contributed to 80%+ of the interaction and mockup designs, as seen on top right corner “by_edirc”

The interaction follows Google’s Android TV guideline because most smart TVs in China equipped with Android. Following Android guideline is also the best way to ensure performance and smoothness.

AppleTV’s interaction with iPhone, and touch-wheel were also used as a reference.

High Fidelity Mockups (highlights)

Learnings

-

Quantitative methods can produce strong evidence for qualitative study, transforming heuristics into well-supported opinions.

-

It’s important to have a concise, high-level, yet clear idea to guide the design, just like the product concept mentioned above. With it, even though we digressed a few times along the way, we managed to adhere to the core concepts.

-

I need to be careful not doing research/analysis to prove that we are right. I only looked at evidence that supports ourselves, and ignored those who disagree. Eventually reaching a biased conclusion.

-

Yet, it’s difficult to predict the future, just like no one expected the bankrupt of LeTV (乐视). However, these attempts are not futile, because I have learned and grown from it.